As you have all heard, interest rates have notably risen in the last few months. Below is a chart to help you understand the impact of rising rates. On May 1, 2013 a buyer could have purchase a home for $500,000 with a 20% down payment at an interest rate of 3.25% on a 30… Read more

Monthly Archives: June 2014

Five Key Take-Aways on America’s Housing Market

Fannie Mae’s chief economist, Douglas G. Duncan met with the L.A. Times editors and reporters to share his views on where the housing market is headed. Here are five key takeaways: Housing isn’t really going gangbusters. Despite those eye-popping price jumps, housing is not in a bubble or even a boom. Real estate is also… Read more

Prop 60 & 90 Allows for One-time Transfer of Tax Base for Seniors 55+

Proposition 60 and 90 is an affordable way for Senior Property Owners age 55 and older to move since it allows them to transfer their tax base one-time. The Replacement property has to be equal value or less and must be purchased within two years. Please note Riverside County began participating again on September 13, 2013. Please… Read more

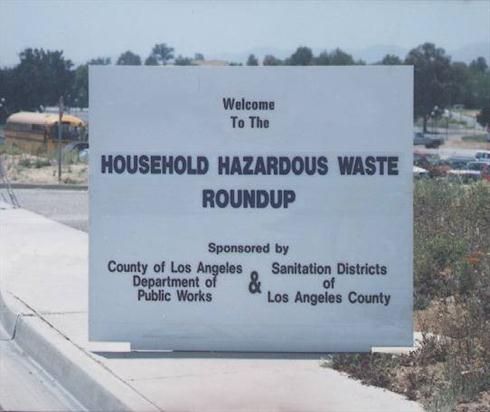

Household Hazardous Waste Event on 6/21 at Pasadena’s Rose Bowl

We encourage you to check out this coming Saturday’s Household Hazardous Waste Event on June 21, 2014 from 9 a.m. to 3 p.m. at the Pasadena Rose Bowl, Parking Lot K. Sponsored jointly by the Los Angeles County Sanitation Districts and the Department of Public Works. The Household Hazardous Waste (HHW) Collection Program gives Los… Read more

Low Rates and High Rents are converting Homeowners into Landlords

From CNN Money. Low mortgage rates and soaring rents have convinced a growing number of homeowners to hang onto their former homes and become landlords instead.